Introduction: The SaaS Finance Struggle

If you’re building a SaaS company, you already know the unique financial tightrope founders walk. One month your ARR (Annual Recurring Revenue) looks solid, the next churn bites into your runway. You’re under pressure from investors, employees, and customers to scale fast—but without burning cash irresponsibly. That’s where the best fractional CFOs for SaaS companies come in. They provide the embedded expertise of a full-time executive without the full-time cost, helping you balance growth with financial discipline.

Why SaaS Companies Need a Fractional CFO

Unlike traditional businesses, SaaS companies live and die by recurring revenue metrics and growth efficiency. A fractional CFO provides specialized knowledge to help you:

- Model ARR & MRR: Accurately forecast recurring revenue and uncover growth levers.

- Monitor Churn: Analyze where customers are leaving and how to improve retention.

- Optimize CAC/LTV: Balance acquisition costs with long-term customer value.

- Extend Runway: Ensure capital efficiency so you’re investor-ready for the next round.

Fractional CFOs don’t just “do the numbers.” They become strategic partners who guide your financial narrative for investors and align operations with growth goals.

Core Roles of the Best Fractional CFOs for SaaS

1. Strategic Financial Planning

A great fractional CFO creates dynamic financial models that evolve with your company. They stress test different scenarios: rapid scale, slower adoption, or higher churn. This gives you confidence when presenting to investors.

2. Investor Confidence & Storytelling

Raising capital isn’t just about showing metrics—it’s about crafting a compelling story. A SaaS-savvy CFO understands what VCs want: efficient growth, clear CAC payback, and strong retention. They help you package these insights into pitch decks and due diligence documents.

3. Burn Rate & Runway Management

Every SaaS founder knows burn rate can make or break fundraising timelines. A fractional CFO introduces frameworks to manage expenses while protecting innovation and talent investment.

4. SaaS Metric Dashboards

Beyond traditional P&L statements, fractional CFOs design dashboards that track:

- Net Revenue Retention (NRR)

- Gross Margins

- Churn rate (logo and revenue)

- Customer Acquisition Cost (CAC)

- CAC Payback Period

These dashboards give both the leadership team and investors confidence in financial health.

Framework: How a Fractional CFO Adds Value to SaaS Companies

Here’s a simple framework to understand the role:

| Area | SaaS CFO Impact |

|---|---|

| ARR Growth | Forecasts revenue with scenario modeling |

| Churn Reduction | Identifies patterns and suggests retention strategies |

| CAC Optimization | Balances sales/marketing spend with return on investment |

| Runway Management | Extends capital efficiency while preparing for fundraising |

| Investor Relations | Builds confidence with metrics-driven storytelling |

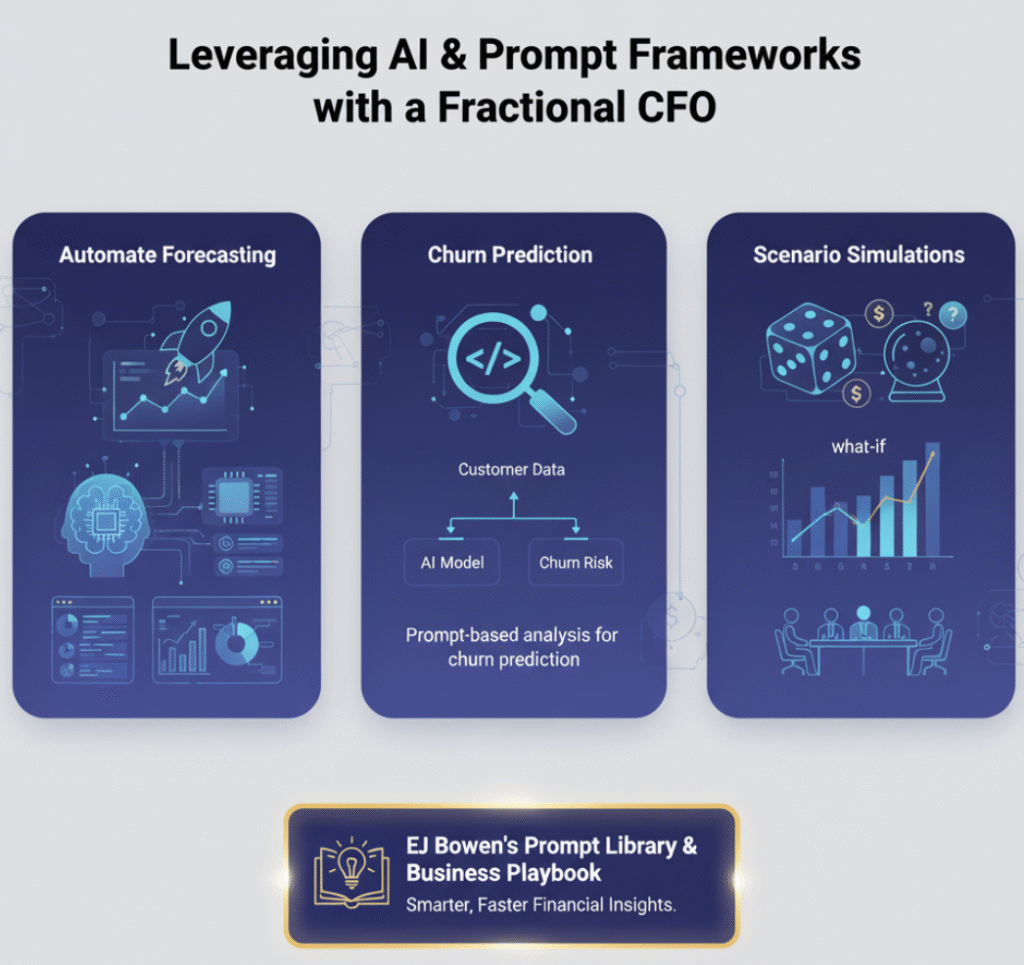

Leveraging AI & Prompt Frameworks with a Fractional CFO

Today’s best fractional CFOs don’t just rely on spreadsheets. They use AI-powered workflows to:

- Automate revenue forecasting with predictive models.

- Build prompt-based analyses for churn prediction.

- Create quick scenario simulations for board meetings.

If you’re new to leveraging AI in finance, EJ Bowen’s Prompt Library and Business Playbook provide a great starting point. These tools help both founders and CFOs collaborate on smarter, faster financial insights.

FAQ: Best Fractional CFOs for SaaS Companies

1. What’s the difference between a SaaS-focused fractional CFO and a generalist CFO?

A SaaS-focused fractional CFO specializes in subscription-based metrics like ARR, churn, and CAC, whereas a generalist may lack this industry-specific expertise.

2. When should a SaaS company hire a fractional CFO?

Most founders engage a fractional CFO once ARR reaches $1M+ or when preparing for Series A fundraising. Earlier engagement is helpful for building investor-ready models.

3. Can a fractional CFO replace a full-time CFO?

Yes—at early and growth stages, fractional CFOs often provide the same strategic guidance at a fraction of the cost until the business scales enough to justify a full-time hire.

4. How do fractional CFOs help reduce churn?

By analyzing customer behavior, segmenting cohorts, and modeling lifetime value, fractional CFOs help design proactive retention strategies.

5. What should I look for when choosing the best fractional CFO for SaaS?

Look for experience in SaaS metrics, investor relations, and strategic financial modeling, not just accounting expertise.

Final Thoughts: Why NeoGig is Your Partner for SaaS CFO Talent

Hiring the best fractional CFO for your SaaS company could be the difference between scaling sustainably or running out of runway too soon. At NeoGig, we connect you with executive talent who know SaaS inside out—leaders who can manage your ARR, CAC, churn, and investor storytelling with precision. Whether you need guidance for a single project or ongoing leadership, NeoGig ensures you get the right executive at the right time.